Revenue – Costs = Profit?

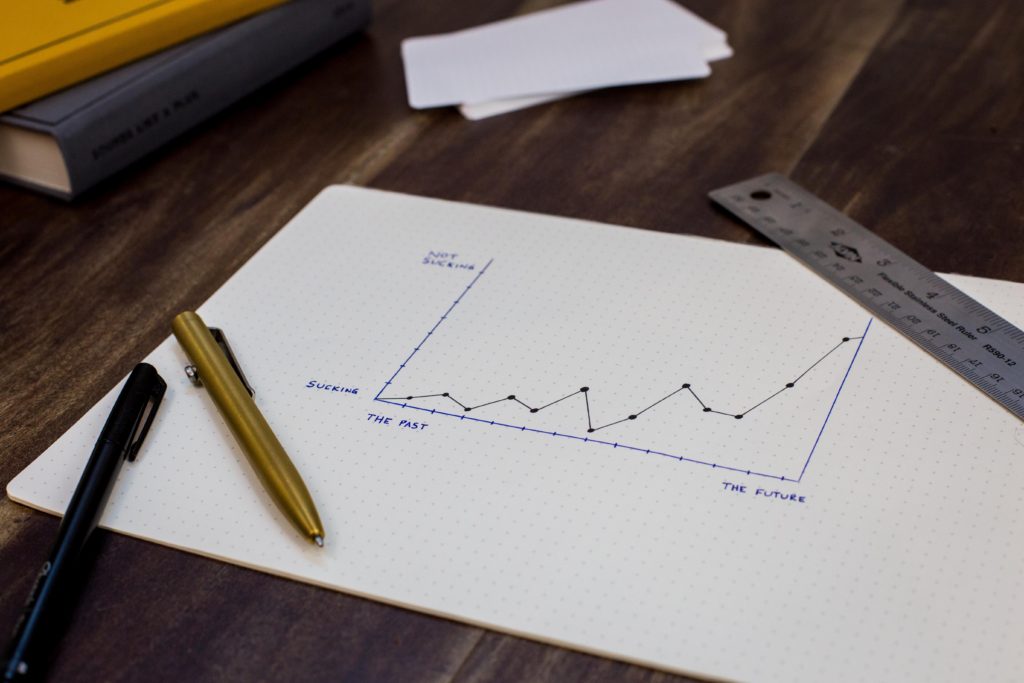

The traditional calculation to determine profit is revenue minus costs. It’s a great tool, and very handy. It just doesn’t give you the full picture. The Profit and Loss Sheet (aka Income Sheet, Income Statement) is supposed to tell you how much you have in profit, but that never seems to be the case. That’s why I hear people tell me “I don’t trust my profit and loss sheet.” Instead, they look at cash in the ban. But in the age of credit cards that’s just as misleading. So, where should you look to help determine real profit? Bob Kaplan from Harvard has an answer.

The TRUE Cost of Doing Business

How to Get Started

If you really want to know how much money you’re making re-allocate your overhead and break out your costs on a per-unit basis. Take all of your costs including your fixed costs like rent, and divide them by the total units/services you produced/performed. You add all those per unit costs together to get the total cost per unit produced. Then, once you’ve figured that out, take your revenue and divide it by the total number of units produced to get your revenue per unit. Once you have the per-unit revenue and true costs per unit, you can plug it into the profit equation and get the profit per unit.

Knowing your profit per unit will open a whole world of options. You’ll know whether you need to change your pricing. You can calculate how much money you can expect to take home if all your units sell. You can make management decisionsf like targeted cost reductions, knowing which products or services drive growth, and which product lines should be jettisoned. With that, you can go make your mark on the world.